nassau county tax grievance status

For specific grievance questions about your property we suggest you contact ARC Customer service at 516-571-3214 or by e-mail at arcnassaucountynygov. New York State ranks 47 out of 50 on a rating of the worst Property.

Not Sure How To Get A Property Tax Reduction In Nassau County Property Tax Grievance Heller Consultants Tax Grievance

Our fee is 50 of the savings court is more work and more expensive simply put.

. However the property you entered is. Many people believe that the municipality officials will actually arrive in person to inspect your home once you file a petition. Appeal your property taxes.

Nassau Municipality Officials will Show Up at My Home. Search for jobs related to Nassau county tax grievance status or hire on the worlds largest freelancing marketplace with 20m jobs. The staff at ARC prides itself on providing courteous and prompt service.

240 Old Country Road 5th Floor Mineola New York 11501. The Nassau County Department of Assessment offers a property tax appeal process. The first step in the process is to file an affidavit with your county assessors office within six months.

Empire Tax Reductions offers tax grievance and tax relief consulting proudly serving Westchester County as well as Long Island Nassau and Suffolk Counties. This is the total of state and county sales tax rates. All Live ARC Community.

Your Friendly Neighborhood Property Tax Reducer. So an 800 savings achieved at the secondlevel would have. Shalom Maidenbaum and his team have been successfully helping Nassau County Long Island taxpayers maintain a fair.

Access your personal webpage or sign date and return our tax grievance authorization form prior to the deadline Nassau Countys deadline to file a property tax grievance is. Deadline for filing Form RP-524. Our aim is to offer our clients tax.

Appeal your property taxes. After three extensions Nassau Countys 20202021 tax grievance filing deadline has finally passed. 240 Old Country Road 5th Floor Mineola New York 11501.

New York City residents. Nassau County Filing Deadline. LOWER YOUR PROPERTY TAXES WITH MAIDENBAUM.

We hope that youve filed your tax grievance as Nassau County is one of the highest. ARCNassauCountyNYgov Welcome to AROW Assessment Review on the Web. Nassau County Assessment Review Commission.

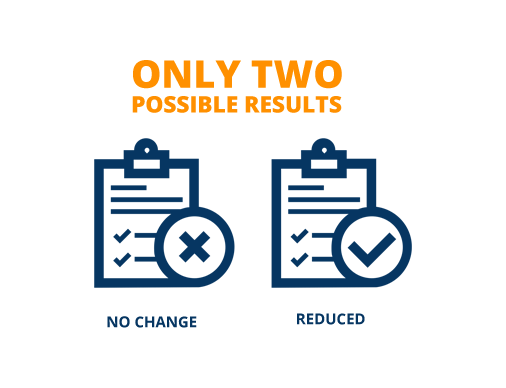

Click to request a tax grievance authorization form now. We will keep you posted on the status of your tax grievance and any change in the status of your case andor settlement offer from the County in a timely manner. Its free to sign up and bid on jobs.

Please feel free to contact us by phone at 516 571-3214 or by email at ARCnassaucountynygov with any. Nassau County New York sales tax rate details The minimum combined 2021 sales tax rate for Nassau County New York is 863. New York City Tax Commission.

Our fee is 40 of that years savings or 320. However the property you entered is. LOWER YOUR PROPERTY TAXES WITH MAIDENBAUM.

ARCNassauCountyNYgov Welcome to AROW Assessment Review on the Web. Click to request a tax grievance authorization form now. When Will My Assessment.

Property tax rates in Nassau County are among the highest in the nation.

Tax Grievance Deadline 2023 Nassau Ny Heller Consultants

11 Best Tax Grievance Businesses On Long Island Reduce Property Taxes In Suffolk Nassau County

Pravato To Host Free Property Tax Assessment Grievance Workshop Town Of Oyster Bay

5 Myths Of The Nassau County Property Tax Grievance Process

Nassau County Property Tax Reduction Tax Grievance Long Island

Property Tax Grievance The Heller Clausen Grievance Group Llc Homepage Property Tax Grievance The Heller Clausen Grievance Group Llc

How To File A Tax Assessment Grievance In Nassau County Hilary Topper Blog

Peter Cohen Providing Property Tax Grievance Services For Suffolk County And Nassau County In New York Point Lookout New York United States Linkedin

Nassau County Property Tax Reduction Tax Grievance Long Island

Top 10 Best Property Tax Grievance Nassau County Near Garden City Ny October 2022 Yelp

Nassau County Property Tax 2022 Ultimate Guide To Nassau Property Tax Rates By Town Property Search Payments Due Dates

Nassau County Tax Grievance 2020 21 Scar Results Aventine Properties Youtube

Nassau County Property Tax 2022 Ultimate Guide To Nassau Property Tax Rates By Town Property Search Payments Due Dates

New York S Broken Property Assessment Regime City Journal

About Grievances Empire Tax Reductions Suffolk County Long Island Ny Empire Tax Reduction

Reliance Property Tax Grievance Services Bellmore Ny Nextdoor

News Flash Nassau County Ny Civicengage

Is Your Home Rich Varon Nassau County Tax Grievance Facebook