food tax in maryland

This page describes the. Web However if the food is consumed on the premises a Maryland food tax can be included on the final bill.

Exemptions From The Maryland Sales Tax

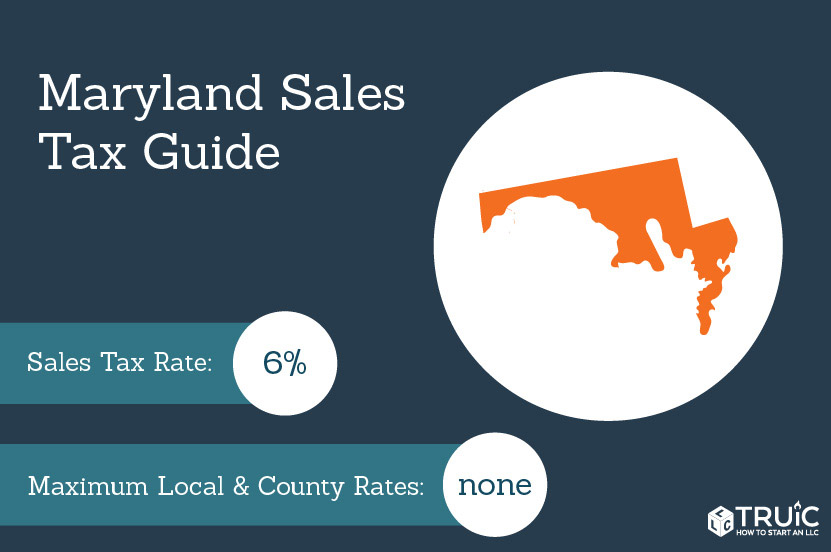

Web In general food sales are subject to Marylands 6 percent sales and use tax unless a person operating a substantial grocery or market business sells the food for.

. Web Some state definitions can make food and candy taxation counterintuitive. Web All other organizations must issue a resale certificate with their Maryland sales and use tax license number to purchase items tax-free for resale. Web Because a sale that is subject to both sales and use tax and admissions and amusement tax is capped at 11 you must charge the 9 sales and use tax on the sale of the alcoholic beverages and apply the admissions and amusement tax to the gross receipts from the sale of alcoholic beverages at a rate no higher than 2 even if the jurisdiction.

Web This local sales tax on food and beverages is imposed for the purpose of paying the principal and interest on bonds issued to finance the construction reconstruction repair. Other businesses that must charge a tax on food. Web Despite opposition from the pet food industry the amended bill passed overwhelmingly in both houses of the maryland legislature.

Exact tax amount may vary for different items. Web A Maryland FoodBeverage Tax can only be obtained through an authorized government agency. Web In general food sales are subject to Marylands 6 percent sales and use tax unless a person operating a substantial grocery or market business sells the food for consumption.

Depending on the type of business where youre doing business and other. Web In addition tax applies to the sale of all other food in vending machines including prepared food such as sandwiches or ice cream. Web What Groceries Are Taxed In Maryland.

The Maryland state sales tax rate is 6 and the average MD sales tax after local surtaxes is 6. Your gross receipts from. Web 2022 Maryland state sales tax.

A caterer serving food at a customers premises must collect the tax on the food sold. Exact tax amount may vary for different items. A caterer must collect the tax in this situation even if the caterer also conducts a.

Web Maryland passes pet food fee some call it a tax Proceeds will fund statewide spay-neuter program. Web Maine Prepared foods are taxable in Maine at the prepared food tax rate of 8. Purchase breakfast lunch or.

Vendors should multiply their. Web The Maryland state sales tax rate is 6 and the average MD sales tax after local surtaxes is 6. Twenty-four states align with the Streamlined Sales and Use Tax Agreement SSUTA.

An interesting development in 2013 state legislation was Marylands passage of SB 820 which imposes a fee on pet food to fund a statewide spay-neuter program aimed at low-income communities. By Eduardo Peters August 15 2022 August 15 2022 In general food sales are subject to Marylands 6 percent sales and. A grocery or market business is considered substantial if sales of grocery or market food.

Web However food items that are prepared for consumption on the grocers premises or are packaged for carry out are considered prepared food and are subject to. Web While Marylands sales tax generally applies to most transactions certain items have special treatment in many states when it comes to sales taxes.

Maryland Income Tax Calculator Smartasset

Hogan Lawmakers Agree To Suspend Gas Tax In Maryland Latest News Wboc Com

Petition Junk Food Tax In Maryland Change Org

Maryland Named No 2 Least Tax Friendly State By Kiplinger Baltimore Business Journal

Your Guide To Maryland S Tax Free Weekend 2022

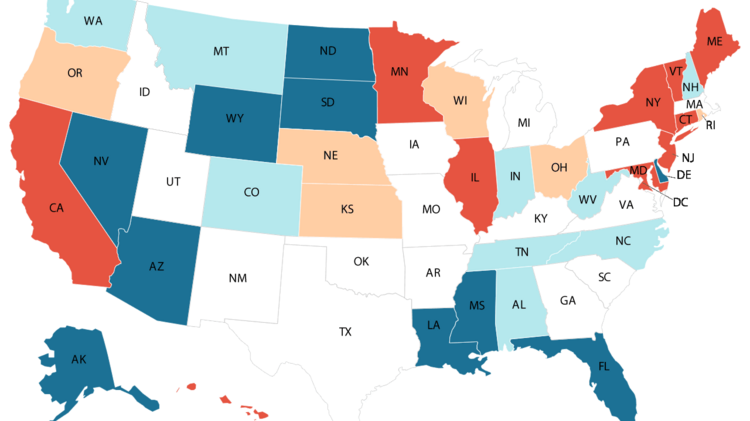

Sales Taxes In The United States Wikiwand

States That Still Impose Sales Taxes On Groceries Should Consider Reducing Or Eliminating Them Center On Budget And Policy Priorities

Ask Eli Does Virginia Washington Dc Or Maryland Have The Most Favorable Taxes Arlnow Com

How To Start An Llc In Maryland For 49 Md Llc Registration Zenbusiness Inc

Sales Tax Laws By State Ultimate Guide For Business Owners

Maryland Sales Tax On Tips Avalara

Maryland Sales Tax Small Business Guide Truic

Tennessee Guidance Issued On Sales Tax Holiday For Prepared Food And Food Ingredients

Bad Habits Hard Choices Using The Tax System To Make Us Healthier Perspectives Fell David 9781907994500 Amazon Com Books

Sales Tax Laws By State Ultimate Guide For Business Owners

![]()

Restaurant Meals Program Maryland Department Of Human Services

As Food Prices Soar Some States Consider Cutting Taxes On Groceries

Need Help With Food Utilities And Tax Prep 2 1 1 Is Only A Call Away The Baltimore Times Online Newspaper Baltimore News